A nurse earns $800.00 per week before any tax deductions. The following taxes are deducted each week: $83.00 federal income tax, $38.00 state income tax, and $79.00 Social Security tax. How much will the nurse make in 4 weeks after taxes are deducted?

A. $2,600.00

B. $3,000.00

C. $2,400.00

D. $2,800.00

we need to find the net income of the nurse in 4 weeks from the weekly net income.

Weekly net income=gross income-total tax

Total tax=federal income tax+state income tax+Social Security tax

Total tax=$(83.00+38.00+79.00)

Total tax=$200.00

Weekly net income=$(800.00-200.00)=$600.00

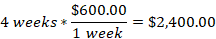

In one week, the net income of the nurse is $600.00 and in 4 weeks the nurse will a net income of:

The nurse will earn $2,400.00 in 4 weeks after taxes are deducted.

Therefore, the Correct Answer is C.